Nuclear energy gets a bad rep. But is it justified ?

The Trump Effect - UR Energy In Spotlight A Triple Play

Profit From Uranium

Valued at $4.5 billion, Cameco is the world’s top uranium business. It produces and sells uranium worldwide. UR Energy is smaller however upside volatility could provide a much more exciting ride .

Over the past decade, both of these company shares have dropped along with the price of uranium. But it’s worth noting that most commodities have moved lower including gold during this period. And like any market, commodities the move in cycles.

Uranium should start to swing back sooner rather than later. Lower prices in the interim mean now is a perfect time to get in. Don’t let overreaction to rare events scare you away from the next uranium bull market.

The "Trump Effect" will propel these commodities prices higher especially Uranium

|

Misconceptions

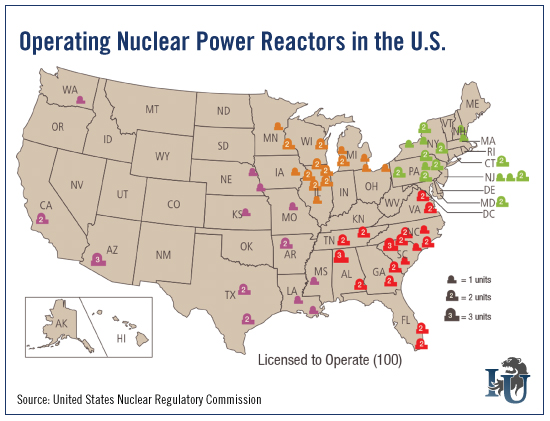

Another common misconception? That nuclear is just a small piece of our energy mix. Yet in our chart above, you can see there are currently 100 operating reactors in the United States. In 2015, nuclear made up 20% of U.S. electricity. Fossil fuels generated 67% of our power.

Now here’s the part that’s key to investors…

A Powerful Resource on the Verge of a Comeback

Interest in nuclear energy is building again. In 2012, the U.S. Nuclear Regulatory Commission approved the construction of four new reactors. It’s the first time this has happened since the 1970s.

Governments across the globe are realizing nuclear is a cheaper, better option. And this should push the price of uranium higher.

Articles Of Interest