The Peak

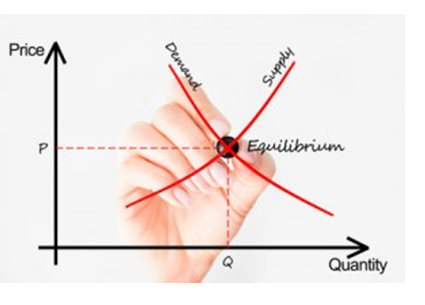

Major Lithium producers' stock values peaked earlier this year after a robust growth spurt beginning in 2016. Currently, major players, Albemarle (ALB), Sociedad Quimica y Minera de Chille (SQM) and FMC Corp. (FMC) are off their earlier highs and in consolidation. That process continues to be affected by an ever changing perceived balance in the equation between current and future global supplies of Lithium weighed against the growing demand for Lithium-ion batteries.

Chart Update

Article - Seeking Alpha

About MiningNewsReporter.com :

MiningNewsReporter.com is a subsidiary of Target Publishing Inc, and is a leading publisher of todays market and investment news, commentary, proprietary research and videos from seasoned journalists, analysts and contributors covering the financial markets and global economies. Leveraging our extensive distribution network and social media presence, we have cultivated a valuable audience of engaged market enthusiasts, which in turn delivers a variety of unique opportunities for industry partnerships, corporate communications, market exposure and investment. We have been paid cash for this report . We purchased 100,000 shares of stock in DJI in Dec 2017

A complete disclaimer can be viewed HERE